Property tax assessment too high...what you can do about it?

by Trey Grubert

Property tax assessment too high...what can you do about it?

An increase in home values is great because it increases the equity in your home without you having to invest more money in making it happen.

Unfortunately, as the price of your home increases, so does the perceived value of your home in the eyes of your local tax assessor.

When that happens, your taxes also go up.

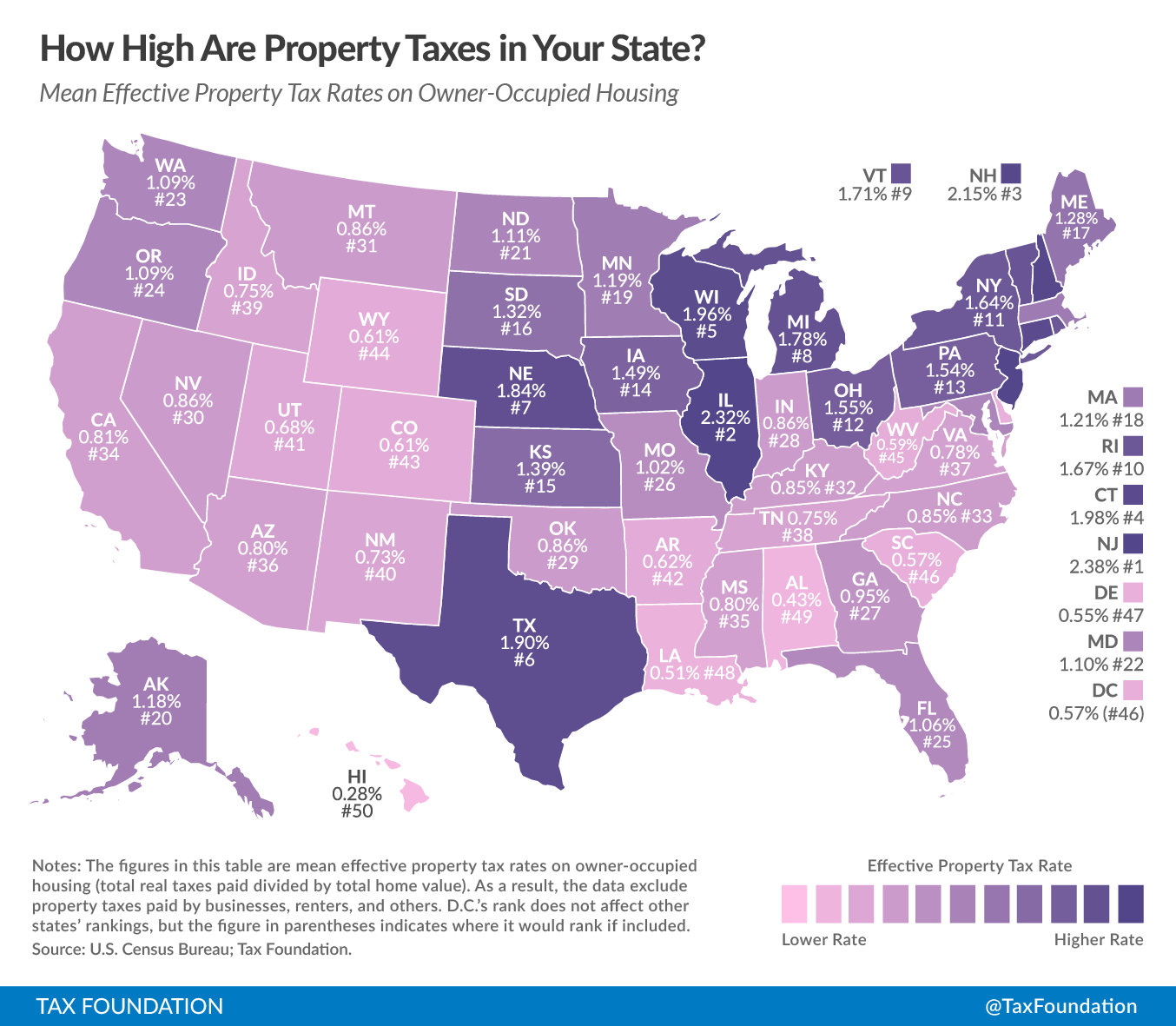

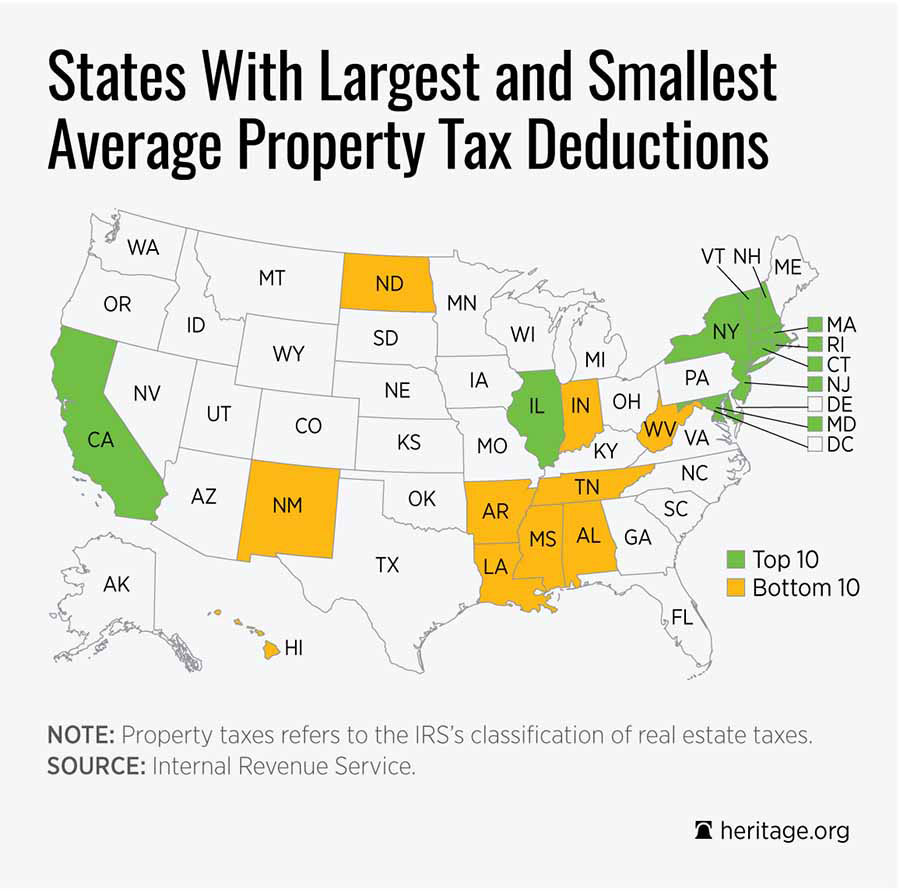

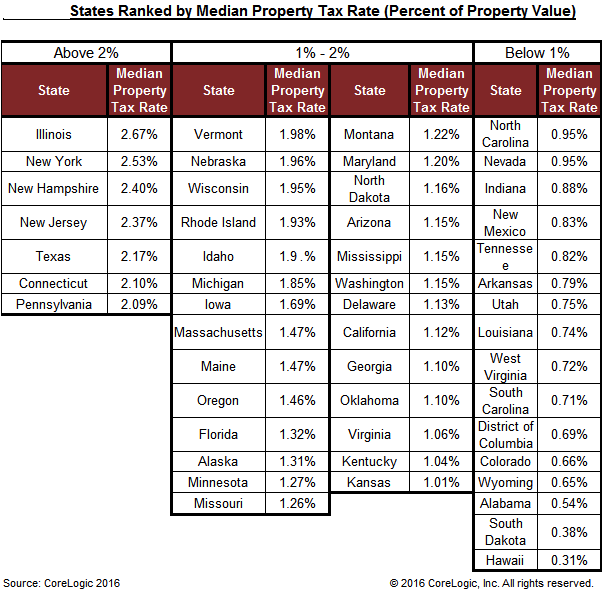

The bad news is that your tax rate - the annual percentage of your home’s value that you pay - is fixed by the state and/or municipality in which you live and not able to be negotiated.

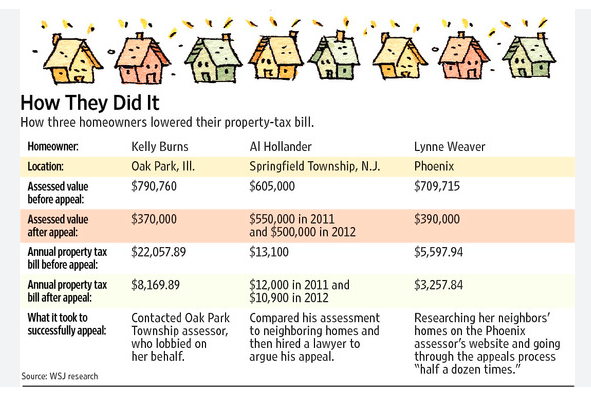

The good news, though, is that you can appeal the assessed value of your home in an effort to reduce the total amount that you pay.

If your property tax assessment is too high, here’s what you can do about it.

Negotiating a lower assessment

Here’s what you need to know up front: appealing the assessment of your property’s value isn’t particularly enjoyable, nor will it guarantee that your taxes go down. In fact, once you go through the process, you could find your property’s actual market value is actually higher than the current assessment, triggering a higher tax payment.

Filing an appeal is often free and doesn’t require you to jump through a lot of hoops to execute. Ideally, with just a little time invested and some good investigative work, you could actually lower your tax assessment and subsequently, your taxes in the process.

What’s even better, a reduction in your tax assessment value could lead to you saving a bunch of money over the near and long term. As well, if you are thorough in doing your research and get great back up to make your case for a lower assessment, you might also be able to request a refund for overpaid property taxes from previous years.

That's the best case scenario, however, and not something you should expect.

Determine when appeals can be filed.

Each municipality has an appeals process and you should familiarize yourself with it before you get started with your research and communication with your city’s tax assessor’s office. There will likely be a window as to when appeals can be submitted with a deadline for the last time an appeal will be accepted.

There should be information on your local assessor’s website on how to complete the whole process. Absent that, you might have to call the assessor’s office and get the details.

There’s no bad reason to challenge your assessed value — though after a renovation or a recent purchase are best — so don’t be afraid to give it a go.

Look for errors on your assessment

Annually, your tax assessor sends you a letter telling you what the assessed value of your home is. If the numbers make sense, it’s likely you won’t want to do anything. However, if you think your assessed value is lower than what the city has pegged it at, you may want to challenge it.

If you’re going to ask for a lower assessed value, the first place you’re going to look is the description of your property on the letter you received from the tax assessor. As an aside, if you don’t see the description on the letter, you can look online or go to the tax assessor’s office and look at your property tax card for the details.

With the rapid growth in home sales and prices over the last five years, it’s not uncommon for your local tax office to list an extra bathroom or add square footage to your property. And, since the tax assessor’s office does most of their work from the office, a lot of what they do is automated and software driven and not as a result of walking through your home.

If there are errors, identify what they are and then find a local real estate agent who can help you determine the real value for the changes that need to be made and even the total updated value for your home.

This info will be the foundation for your appeal.

Get even more back up for your appeal

In order to have a fighting chance in getting a reduction, you’ll want some supporting evidence that your home’s value is lower than stated in your official assessment.

- Get a comparative market analysis

Comparing your home to other homes in your area that are similar in location, style, rooms, bedrooms and amenities that are assessed at a lower price is a great place to start. There’s lots of public information available on homes in your area. As well, you can work with an agent who can provide you with information on homes that are like yours that sold for less money in the last six months to a year.

Between the information they get you and what you find online and at the tax assessor’s office, you should be able to get enough comparable data to justify a lower value if the lower value makes sense.

In the process of finding comps, you just might find a similar home that’s in worse shape than your home, which could really make the case for you for a lower home value. Then, you’d have a strong argument for a lower value for sure.

- Estimate the cost of repairs

If your home needs work - a new roof, foundation issues, updated windows, etc. - it might lower your property’s value enough to impact your taxes. Take the time to put an honest assessment together of what needs work and then create an estimated cost for repairs. Be sure to take pictures as proof.

- Make a note of changes in your neighborhood

Your property’s value isn’t just based on what’s happening on your lot. It also has to do with the surrounding area and what’s happened with other homes in your neighborhood as well. If nearby houses were recently foreclosed on or local schools’ rankings dropped, your property could be valued lower than it was during the last assessment.

- Get the home appraised

Who knows the value of homes in the market better than a licensed home appraiser. Sure, it might cost you $300 to $500, but if it’s going to save you twice that, or more, in the long run, it’s a good investment. If you are going to hire an appraiser, be sure that your initial research indicates that you have a fighting chance at lowering your value first. You don’t want to do it on emotion and be out of money unnecessarily.

Now it’s time to get to work

Show the assessor’s office your research

Depending on the time of year and how busy the tax assessor’s office is, the appeals process could take a bit of time for you to work through. Some assessor’s offices will be easier to work with than others making the approval process simpler in some areas versus others. Be sure to submit the appeal in the manner in which your county requires of you: online, in person, email, fax or in via US Mail. The more you work within the confines of what they expect from you, the easier it will be for you to work with them.

All of this said, It could take many weeks to months to hear back. If you don’t get the response you expect and they’re not willing to lower your assessed value, you could file another appeal with an independent review board.

Get some help

If you don’t have the time or desire to do it yourself, you could hire a lawyer or a property tax consultant to do the work for you. If you can, find a company that does work on a contingency basis. If your case looks good enough, they’ll do the work and only get paid if your taxes get reduced.

If you do get good news, then it was worth the effort.

In the end, be sure to do your due diligence and put together a great package of back-up information so you have a real chance of getting a lower value. If you’re thinking of selling your home shortly after you do all this work, please remember that a lower assessed value might impact how much someone is willing to pay for your home.