What's the right amount of money to spend in upgrading your home?

by Trey Grubert

What's the right amount of money to spend in upgrading your home?

You’re wanting to freshen up your house a little bit and you’ve already determined what you think you should do to make it amazing for you to really enjoy it.

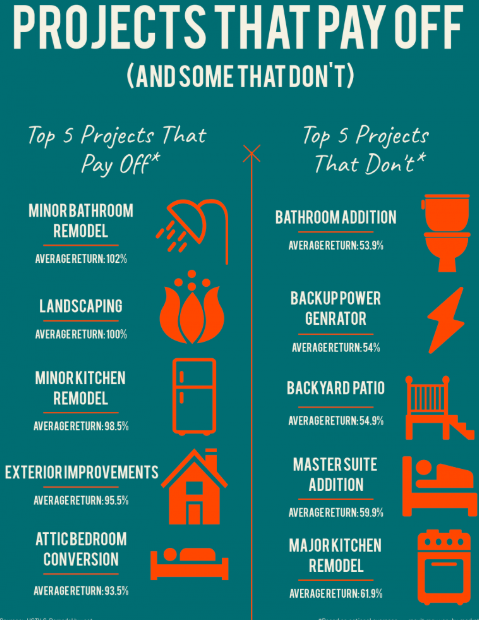

Before you jump into your renovation project, make sure you set a budget so you can spend the right amount of money upgrading your home. Without a plan and a budget, you can spend tons of money on all kinds of neat options — from a new marble island-top for your kitchen to a swanky hot tub for your backyard patio — that you just won’t get back even a fraction of what you paid to install when you sell your home a few years down the road.

Now, you might be staying for a long period of time and this may not be a huge concern for you. But plans change all the time and you want to make sure that you can get at least a portion of what you spent back in the event you need to leave sooner. Overall, it pays to limit your spending to what you might reasonably hope to get back when, and if, you do sell.

If you are going to forge ahead with renovations, you’ll want to take these suggestions into serious consideration:

Hire a Professional

Most homeowners are not talented contractors: plumbers, flooring experts, electricians, finish work experts, etc. As such, it’s obvious when you see their home that they did the work and not a professional. This is bad because it kills both the actual and perceived value of a home. Any work they did that was shoddy will need to be redone by the new homeowner after they move in.

It might only cost a few hundred dollars for several gallons of paint, some rollers and a brush or two, but it will cost $1,500 to $3,000 to fix the job and have the room(s) totally repainted.

Do yourself a favor and pay the extra money to have a professional do the work you want done and have it done right the first time. The long-term value of quality workmanship will serve you well.

Get an agent’s opinion

Nobody spends more time in homes in the area than real estate agents. Check with your favorite agent to find out if your project is adding value, neutral, or perhaps even taking value away from your home.

If you don’t have a favorite agent, click here to find one who can give you their expert opinion on which upgrades matter.

Again, it’s likely that your agent has been in hundreds, if not thousands, of local homes over the years. They have worked with scores of buyers and sellers and know what works and what doesn’t in a home.

They can be a great asset when deciding what buyers and sellers like.

Heed the Deed Restrictions

Before you spend a dime, be sure that you’re aware of what your deed restrictions dictate. It doesn’t matter if your neighborhood has an HOA or note. Most neighborhoods have some sort of deed restrictions and some of the improvements you’re planning may be prohibited.

Some renovations that may be prohibited by the deed restrictions include:

- Solar Panels (especially if they’re facing the street)

- Converting a single-family home into a multi-family home

- External Storage Buildings

- Fences (sometimes restricted to 6′ or 8′ tall and not in the front yard)

- Restrictions on exterior paint colors, including fence

- Window Unit A/Cs

- Obstructive landscaping

You likely got a copy of your deed restrictions when you bought your home. If you can’t find them, the title company who handled your closing likely can provide you a copy.

It’s also possible that the county clerk might have copies as well.

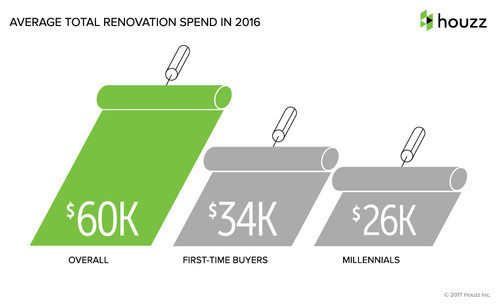

Knowing this, what’s the right amount of money to spend on upgrading your home

A good rule of thumb is to spend no more on each room than the value of that room as a percentage of your overall house value. If you don’t know the value of your home, contact a local real estate agent so they can give you a good idea of what your home will sell for in today’s market.

If you’d like, you can click here to get the current value of your home.

Here’s how the percentages break down for each room:

Kitchen: 10% to 15% of house’s value

Kitchen renovation budget for a:

- $300,000 house: $30,000 to $45,000

- $500,000 house: $50,000 to $75,000

- $750,000 house: $75,000 to $112,500

Master Bathroom Suite: 10% of house’s value

Master bathroom suite renovation budget for a:

- $300,000 house: $30,000

- $500,000 house: $50,000

- $750,000 house: $75,000

Bathroom: 5% of house’s value

Bathroom renovation budget for a:

- $300,000 house: $15,000

- $500,000 house: $25,000

- $750,000 house: $37,500

Finished Attic or Basement: 10% to 15% of house’s value

Attic or basement finishing budget for a:

- $300,000 house: $30,000 to $45,000

- $500,000 house: $50,000 to $75,000

- $750,000 house: $75,000 to $112,500

Other Rooms in the home : 1% to 3% of house’s value

Living room, dining room, or bedroom renovation budget for a:

- $300,000 house: $3,000 to $9,000

- $500,000 house: $5,000 to $15,000

- $750,000 house: $7,500 to $22,500

Patio, Deck, Paths, and Landscaping: 2% to 5% of house’s value

- $300,000 house: $6,000 to $15,000

- $500,000 house: $10,000 to $25,000

- $750,000 house: $15,000 to $37,500

Remember, it’s easy to let your budget get out of control when making improvements to your home. Use the guidelines I’ve laid out here for you as you plan and budget to make renovations to your home.